Revolutionize Mileage Recording with a Mileage Tracker App and a Streamlined Mileage Log

Revolutionize Mileage Recording with a Mileage Tracker App and a Streamlined Mileage Log

Blog Article

Maximize Your Tax Obligation Deductions With a Simple and Reliable Mileage Tracker

In the world of tax deductions, tracking your gas mileage can be an often-overlooked yet crucial job for optimizing your monetary benefits. A properly maintained gas mileage log not only makes certain conformity with IRS requirements however additionally boosts your capability to corroborate company costs. Picking the ideal gas mileage monitoring tool is essential, as it can simplify the procedure and improve precision. However, lots of people fail to fully utilize this opportunity, resulting in potential shed savings. Recognizing the nuances of efficient gas mileage monitoring may expose approaches that can significantly impact your tax circumstance.

Importance of Mileage Monitoring

Tracking mileage is vital for any individual seeking to maximize their tax deductions. Precise gas mileage tracking not just makes sure compliance with IRS regulations however additionally permits taxpayers to take advantage of deductions connected to business-related traveling. For freelance individuals and entrepreneur, these reductions can dramatically minimize taxed revenue, thus reducing general tax obligation liability.

In addition, keeping a comprehensive record of mileage helps compare personal and business-related journeys, which is important for substantiating insurance claims throughout tax audits. The IRS requires certain documentation, including the day, destination, objective, and miles driven for each journey. Without thorough records, taxpayers take the chance of shedding important reductions or dealing with fines.

Furthermore, efficient mileage tracking can highlight trends in traveling costs, helping in much better financial preparation. By analyzing these patterns, individuals and businesses can identify chances to optimize travel paths, decrease prices, and improve operational performance.

Choosing the Right Mileage Tracker

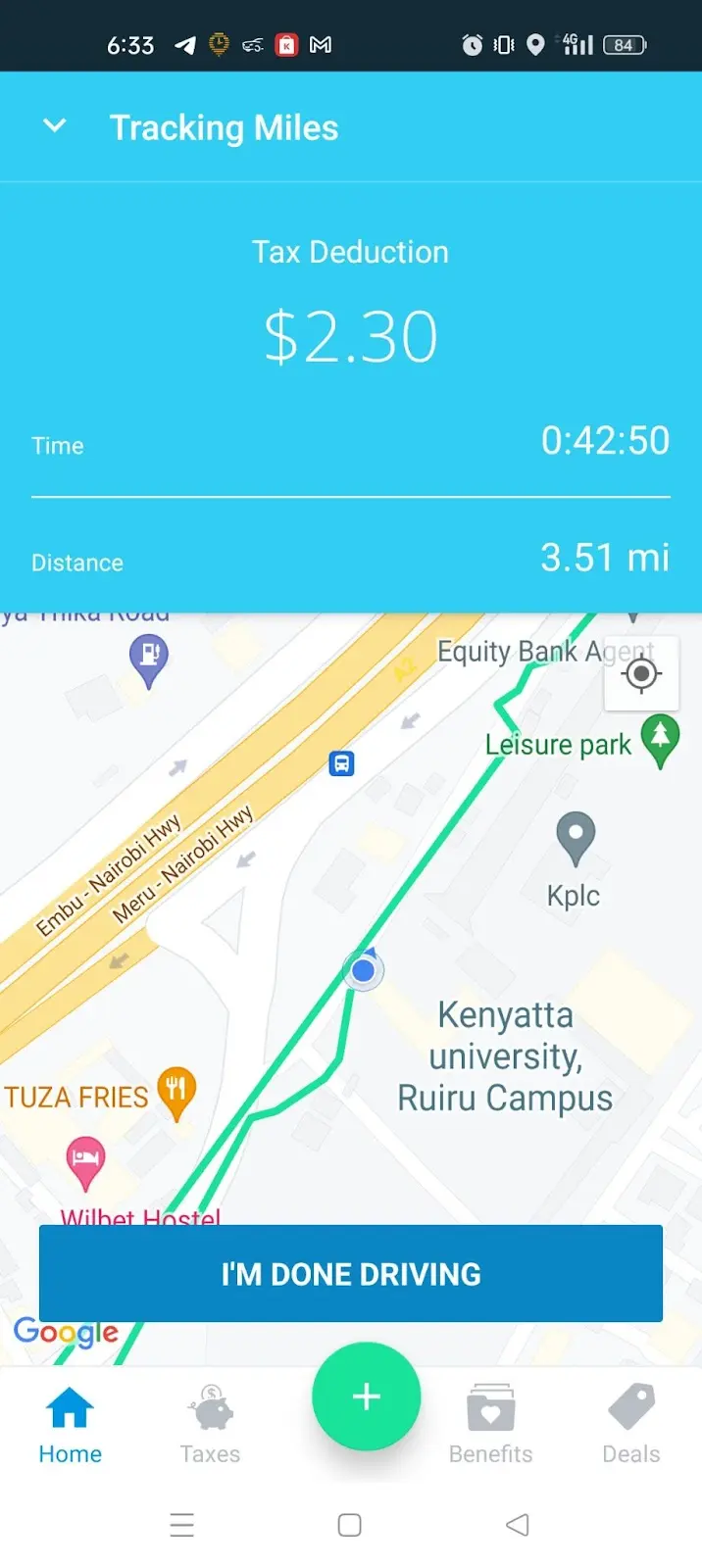

When picking a mileage tracker, it is important to think about different attributes and functionalities that straighten with your specific requirements (best mileage tracker app). The very first aspect to evaluate is the approach of tracking-- whether you like a mobile app, a GPS device, or a hands-on log. Mobile apps often supply benefit and real-time monitoring, while general practitioner devices can supply more accuracy in range measurements

Following, evaluate the assimilation abilities of the tracker. A great mileage tracker need to seamlessly incorporate with accountancy software application or tax prep work devices, enabling simple information transfer and coverage. Seek features such as automated tracking, which reduces the demand for hand-operated access, and classification choices to identify between service and personal trips.

Exactly How to Track Your Gas Mileage

Selecting an appropriate gas mileage tracker establishes the structure for effective mileage management. To accurately track your mileage, start by figuring out the objective of your travels, whether they are for business, charitable activities, or clinical factors. This quality will certainly aid you categorize your trips and guarantee you record all appropriate data.

Next, constantly log your gas mileage. For manual entrances, record the starting and ending odometer analyses, along with the date, function, and path of each journey.

It's also vital to consistently review your access for accuracy and completeness. Set a timetable, such as weekly or regular monthly, to consolidate your records. This practice aids avoid discrepancies and ensures you do not overlook any type of deductible gas mileage.

Lastly, back up your records. Whether electronic or paper-based, keeping back-ups protects against information loss and facilitates simple accessibility throughout tax preparation. this By vigilantly tracking your mileage and keeping arranged records, you will lay the groundwork for optimizing your possible tax deductions.

Taking Full Advantage Of Reductions With Accurate Records

Accurate record-keeping is important for maximizing your tax reductions related to gas mileage. When you keep comprehensive and specific documents of your business-related driving, you develop a robust foundation for asserting reductions that may considerably lower your gross income. best mileage tracker app. The internal revenue service calls for that you record the date, destination, function, and miles driven for each trip. Adequate detail not only validates your insurance claims yet additionally provides protection in instance of an audit.

Using a mileage tracker can click for more enhance this procedure, enabling you to log your journeys effortlessly. Several apps automatically compute distances and classify trips, saving you time and reducing errors. Furthermore, keeping supporting documentation, such as receipts for relevant costs, enhances your instance for deductions.

It's necessary to be regular in tape-recording your gas mileage. Ultimately, accurate and organized mileage documents are crucial to maximizing your deductions, guaranteeing you take complete advantage of the prospective tax obligation benefits available to you as a company vehicle driver.

Typical Blunders to Avoid

Keeping precise records their explanation is a significant step towards maximizing mileage reductions, yet it's similarly vital to be aware of common mistakes that can weaken these initiatives. One widespread mistake is stopping working to document all trips properly. Also minor business-related trips can build up, so ignoring to videotape them can cause substantial shed reductions.

Another blunder is not separating in between individual and organization mileage. Clear classification is crucial; blending these 2 can activate audits and bring about charges. In addition, some people forget to keep supporting records, such as receipts for related costs, which can additionally confirm insurance claims.

Utilizing a mileage tracker app ensures regular and trustworthy records. Acquaint yourself with the latest regulations concerning gas mileage deductions to prevent unintentional errors.

Verdict

In verdict, reliable mileage monitoring is necessary for optimizing tax deductions. Utilizing a reputable gas mileage tracker streamlines the process of tape-recording business-related journeys, making certain precise documentation.

Report this page